15 Proven Ways to Find Trending Products to Sell in 2026

- Why Finding Trending Products in 2026 Is Different

- What “Trending Products” Really Mean in 2026

- Part 1: Early Trend Discovery (Before Heavy Advertising)

- Part 2: Validate Trends With Real Market Signals

- Part 3: Category-Level Trend Expansion

- Part 4: From Trending Product to Profitable Business

- Common Mistakes When Chasing Trending Products

- Conclusion: Winning in 2026 Requires Systems, Not Luck

Why Finding Trending Products in 2026 Is Different

If you feel like finding trending products has become harder than it was a few years ago, you’re not imagining things.

Back in the early dropshipping days, a single viral Facebook ad could carry a product for months. In 2026, that same product might barely survive a few weeks before competitors flood the market, CPMs spike, and margins evaporate. The game has changed—and so must the way you discover trending products.

Shorter Product Life Cycles

The life cycle of trending products in 2026 is brutally short.

Algorithms now surface products to millions of users within days, not months. What used to be an “early mover advantage” window of 60–90 days has compressed into 14–21 days in many niches. This means you’re no longer competing on who finds the product, but on who validates and scales it faster.

The implication is simple: Finding trending products is no longer about hunting unicorns. It’s about building systems that repeatedly catch early signals before they explode—and exit before they collapse.

Algorithm-Driven Discovery on TikTok and Meta

In 2026, discovery doesn’t belong to search engines alone. TikTok, Instagram Reels, and Meta’s recommendation engines now decide which products get attention—and which disappear into the void.

These algorithms don’t reward products. They reward behavior.

A product doesn’t trend because it exists. It trends because:

- People save videos about it

- Comment sections fill with questions

- Creators quietly test it before brands go all-in

Understanding trending products today means understanding how algorithms amplify curiosity, not just clicks.

Why Scalable Products Matter More Than Viral Ones

Viral products are like fireworks—flashy, exciting, and over before you know it. Scalable trending products, though, they’re more like campfires. They take a little longer to light, but once they’re going, they last for months.

Here’s the thing: if you want to win in 2026, stop chasing whatever’s hot right now. The sellers who last aren’t running after every shiny trend—they’re looking for products they can still advertise and make money from tomorrow. That’s the real difference between a hobby seller and someone running an actual business.

What “Trending Products” Really Mean in 2026

Before we go further, we need to reset the definition of trending products—because most people are using the wrong one.

Emerging Demand vs. Saturated Demand

A trending product is not something everyone is already selling.

True trending products sit in an uncomfortable middle ground:

- Demand exists, but isn’t obvious

- Content exists, but isn’t polished

- Ads exist, but aren’t fully optimized

If every top creator is already promoting the product and every brand has 50 ad variations running, you’re not early—you’re late.

Viral Content vs. Scalable Products

A video with 10 million views doesn’t automatically signal a good product.

In fact, many viral videos lead to terrible business decisions because:

- The interest is curiosity-driven, not purchase-driven

- The product lacks repeat usage

- Ads fail once organic hype fades

Scalable trending products, on the other hand, show quieter but more consistent signals—especially in comments, search behavior, and ad testing patterns.

Why Advertising Behavior Is a Core Trend Signal

Let’s be real—most of those Google top-10 articles won’t tell you this: ads show what people really want, way faster than any blog post or article ever could. Creators mess around for the fun of it, but brands? They spend real money to test what works.

When you watch advertisers tweak, pause, or ramp up their ads, you get a front-row seat to see if a product’s just catching attention or if it’s actually worth betting on. That’s where something like Denote Ad Spend comes in handy. You’re not there to copy their ads—you’re there to read the market’s signals, almost like catching a glimpse of its mood before everyone else does.

Part 1: Early Trend Discovery (Before Heavy Advertising)

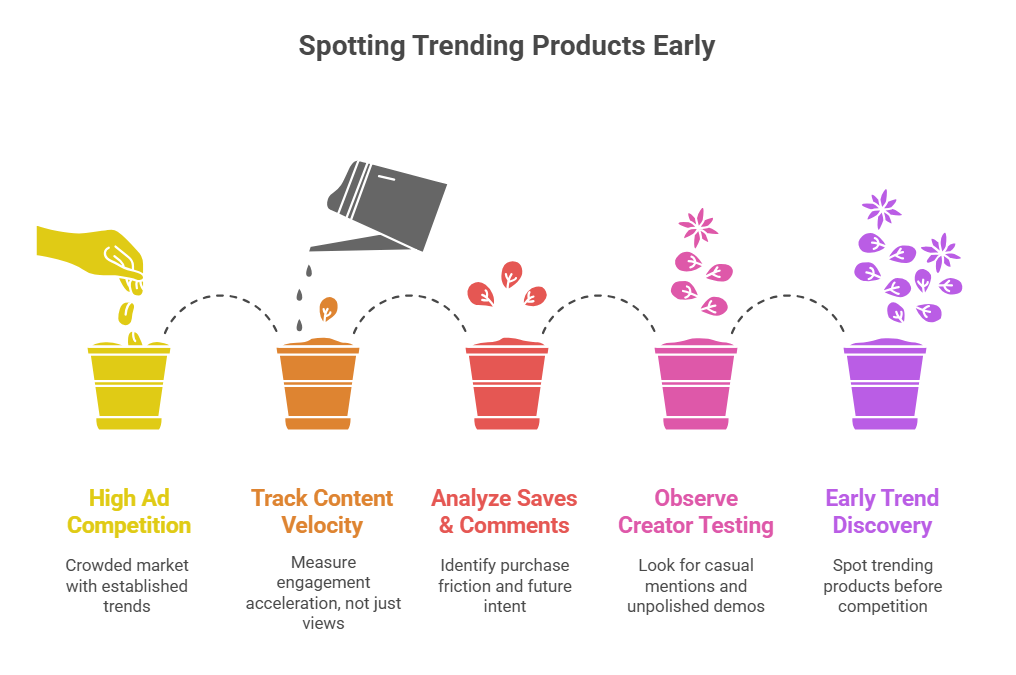

The goal of this section is simple: spot trending products before ad competition explodes.

1. Track TikTok and Reels Content Velocity

Most people obsess over views. That’s a mistake.

Views are vanity. Velocity is truth.

Content velocity measures how quickly engagement is accelerating, not how big it already is. A video growing from 2,000 to 20,000 views in 24 hours often signals stronger early demand than a stagnant video sitting at 2 million views.

Why Saves and Comments Matter More Than Views

Saves signal future intent. Comments signal confusion, curiosity, or desire.

When people ask:

- “Does this actually work?”

- “Where can I buy this?”

- “Is there a cheaper version?”

You’re not seeing entertainment—you’re seeing purchase friction forming. That friction is the birthplace of trending products.

Identifying Early Creator Testing Signals

Early creators don’t sell aggressively. They experiment.

Look for:

- Casual mentions

- “I’ve been trying this lately…”

- Unpolished demos

- No discount codes

These are often the earliest public signals of emerging trending products.

2. Follow Creator-Led Product Mentions Before Brands Scale

Creators are the R&D department of modern commerce.

Before brands spend thousands on ads, creators test products organically. They feel audience reactions long before dashboards do.

Soft Selling vs. Hard Promotion Patterns

Soft selling feels like a recommendation. Hard promotion feels like a campaign.

Trending products almost always start with soft selling:

- No urgency

- No landing page push

- No overproduced visuals

Once you see hard promotion everywhere, the window is already closing.

3. Use Google Search Data to Detect Problem-First Trends

Search engines still matter—but only if you ask the right questions.

Instead of searching product names, search problems.

Long-Tail Intent Keywords With Rising Demand

Queries like:

- “how to fix ___ without ___”

- “best way to reduce ___ at home”

- “alternative to ___ product”

These indicate emerging pain points. When multiple long-tail searches rise together, they often precede the birth of trending products.

4. Mine Reddit and Community Platforms for Repeated Pain Points

Reddit is where trends confess before they perform.

People complain before they buy. They ask for help before solutions exist.

Cross-Post Frequency as Early Validation

When the same complaint appears across:

- Different subreddits

- Different communities

- Different countries

You’re not looking at noise. You’re looking at unmet demand waiting for a product.

Part 2: Validate Trends With Real Market Signals

Early discovery feels thrilling, but let’s be real—it comes with risks. Tons of products blow up in conversations and seem like the next big thing, right up until people actually try to pay for them. That’s where validation comes in. In 2026, it’s not just important—it’s everything. Here, we’re going to sort out which trending products actually matter and which ones are just hype.

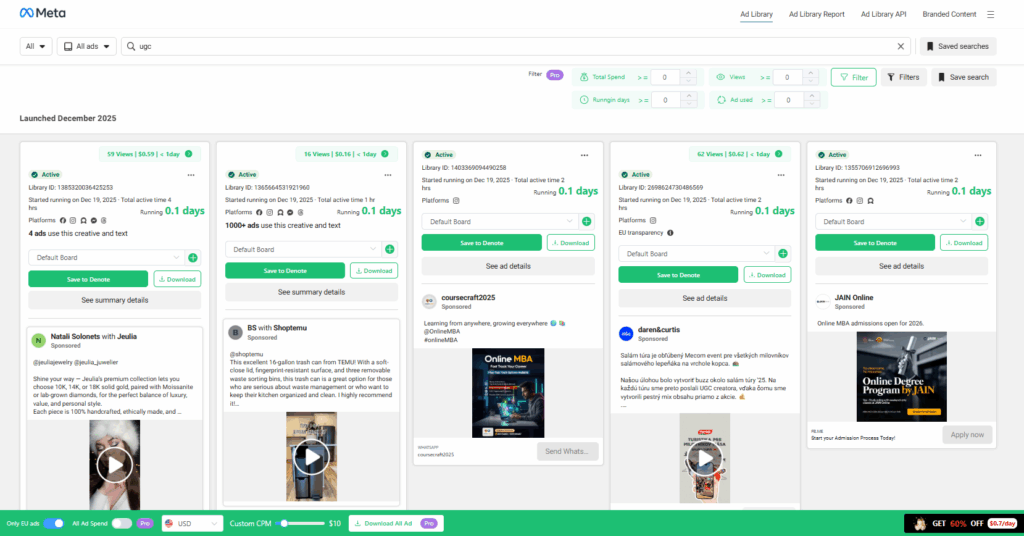

5. Analyze Competitor Ad Testing Behavior

Advertising tells you a lot about what brands are really after. They're not just throwing money at ideas because they look cool—they’re looking for the next big thing that can actually take off.

So when you’re checking out trending products, don’t get distracted by the ads that pop up all over the place. Pay attention to what brands are doing before everyone else catches on. That’s where the real action starts.

Identifying Testing vs. Scaling Patterns With Denote Ad Spend

This is where Denote Ad Spend becomes genuinely useful.

Instead of showing you only “winning ads,” Denote helps you observe testing behavior:

- Small, consistent daily budgets

- Frequent creative rotation

- Multiple messaging angles with similar spend levels

These patterns often indicate a brand is validating a trending product rather than aggressively scaling it. When several brands begin testing similar products with cautious budgets, it’s often a sign of emerging demand—not saturation.

In contrast, when you see one brand dominating spend with minimal creative changes, the opportunity is likely already mature or declining.

6. Measure Ad Spend Momentum, Not Just Ad Volume

Many sellers make the mistake of counting ads instead of reading momentum.

Fifty ads don’t matter if spend is flat. Five ads matter if budgets are doubling week over week.

Creative Rotation vs. Budget Expansion Signals

Creative rotation without budget growth usually means:

- The product is interesting

- Conversion is inconsistent

- The market response is unclear

Budget expansion, on the other hand, is a vote of confidence. When ad spend steadily increases and creatives become more refined, you’re likely watching a trending product move from validation to scale.

Momentum, not visibility, is what matters in 2026.

7. Cross-Validate Organic Trends With Paid Data

Relying on a single signal is how people lose money.

The strongest trending products appear at the intersection of:

- Organic curiosity

- Search intent

- Paid experimentation

Combining Social Signals and Ad Spend Insights

For example:

- TikTok creators show rising engagement

- Google search queries trend upward

- Ads exist, but spend is still controlled

That overlap suggests genuine demand forming—before the floodgates open. When organic signals and paid data confirm each other, your confidence increases dramatically.

8. Avoid Fake Trends Driven by Short-Term Paid Hype

Not all trending products are real. Some are artificially inflated by aggressive ad spending with weak fundamentals.

Red Flags That Indicate Unsustainable Demand

Watch out for:

- One brand responsible for most ad spend

- No organic discussion outside ads

- Sharp spikes followed by sudden disappearance

These “paid-only” trends often collapse the moment CAC rises. Sustainable trending products survive after ad efficiency drops.

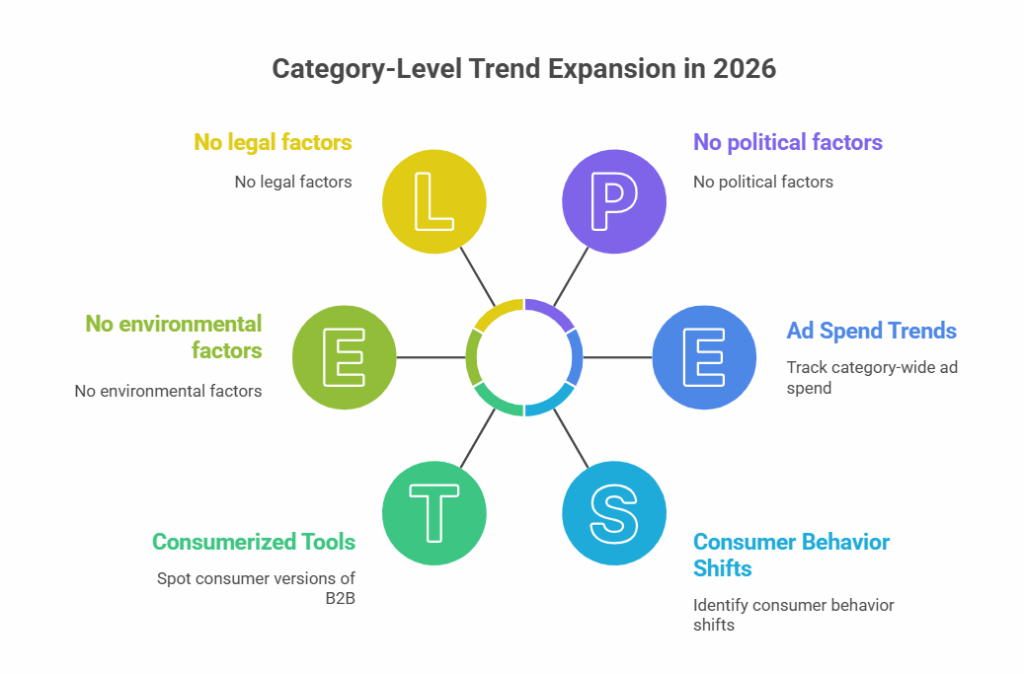

Part 3: Category-Level Trend Expansion

One of the biggest mindset shifts in 2026 is moving beyond single products. Winning sellers don’t ask, “What product is trending?” They ask, “What category is waking up?”

9. Track Category-Wide Ad Spend Trends

Products come and go, but categories tend to grow and stack up over time. With Denote Ad Spend, you can spot when several products in the same niche are getting more attention—more tests, more experiments.

If you see ad spend flowing into lots of variations, whether it’s new brands, different features, or even price changes, that usually means the whole category is heating up.

Using Denote Ad Spend to Identify Expanding Niches

If three or more related products begin attracting consistent ad spend from different advertisers, that’s rarely coincidence. It’s usually demand broadening, not peaking.

This is how you find trending products with longevity rather than short-lived hype.

10. Identify Consumer Behavior Shifts Behind Product Trends

Products don’t trend randomly. They ride deeper waves of behavior.

Convenience, Personalization, and Emotional Drivers

In 2026, many trending products succeed because they:

- Save time

- Reduce decision fatigue

- Feel personally tailored

- Offer emotional reassurance

Understanding why a product trends helps you predict what comes next. Trends driven by behavior shifts tend to last longer than novelty-driven ones.

11. Spot Consumer Versions of Professional or B2B Products

Some of the most reliable trending products come from a familiar pattern: professional tools simplified for consumers.

Why Consumerized Tools Continue to Trend

Think about:

- Studio-quality tools made home-friendly

- Medical or wellness devices adapted for daily use

- Software concepts turned into physical products

These trends work because they borrow credibility from professional markets while tapping into consumer curiosity.

12. Learn From Failed Products to Predict the Next Winning Version

Failure is one of the most underused research tools.

When a product fails despite obvious demand, the reason is rarely “no market.” It’s usually:

- Wrong price

- Missing feature

- Poor positioning

Feature Gaps and Pricing Signals

Reading negative reviews and abandoned ads often reveals exactly what the next version of a trending product should fix. Many winning products in 2026 are simply better answers to yesterday’s mistakes.

Part 4: From Trending Product to Profitable Business

Finding trending products is only half the equation. Turning them into profit is where most people fail.

13. Test Content and Ads Before Inventory Investment

Inventory is commitment. Content is curiosity.

Before tying up capital, test ideas through:

- Organic short-form content

- Small-budget ad experiments

Benchmarking Test Budgets With Denote Ad Spend

By reviewing realistic testing budgets via Denote Ad Spend, you can avoid overestimating demand or overspending too early. Knowing what “normal” testing looks like protects you from emotional decisions.

14. Evaluate Whether a Trending Product Can Become a Brand

Not every trending product deserves a brand.

Brandability and Long-Term Potential Checklist

Ask:

- Does it solve a recurring problem?

- Can it expand into variations?

- Is the audience emotionally invested?

Products that pass these tests are more than trends—they’re foundations.

15. Build a Repeatable System to Find Trending Products

Consistency beats genius.

The most successful sellers in 2026 don’t rely on luck—they rely on routines.

Weekly Discovery, Monthly Validation, Quarterly Scaling

A simple system:

- Weekly: scan content and communities

- Monthly: validate with search and ads

- Quarterly: scale what proves resilient

This rhythm keeps you early without being reckless.

Common Mistakes When Chasing Trending Products

- Entering the market too late

- Copying viral products without validation

- Ignoring ad economics and margins

These mistakes aren’t about intelligence—they’re about impatience.

Conclusion: Winning in 2026 Requires Systems, Not Luck

Finding trending products in 2026 is no longer about chasing whatever looks exciting today. It’s about understanding signals, reading behavior, and building systems that consistently surface opportunity.

Trends don’t reward speed alone. They reward timing, judgment, and discipline.

If you can combine early discovery, real validation, and scalable thinking, trending products stop feeling like a gamble—and start becoming a repeatable advantage.